lexington ky property tax search

The County Clerks Office is responsible for collecting delinquent property tax bills. Lexington Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Lexington Kentucky.

Moving To Lexington Here Are 19 Things To Know Extra Space Storage

The average household income in the Briarwood Drive area is 64694.

. The average lot size on Windfield Pl is 2969 ft2 and the average property tax is 13Kyr. David ONeill Property Valuation Administrator. 59 properties and 59 addresses found on Windfield Place in Lexington KY.

Note that if a property has recently been sold there may have been insufficient time to update the owners. Recording and administration of various official documents. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

Ad Property Taxes Info. 859-252-1771 Fax 859-259-0973. The County Clerk serves as the countys official record-keeper.

Mayor Jim Gray today opened a new payment office to make it more convenient for. The Fayette County Clerk is a separate agency from Lexington-Fayette Urban County Government. Assessor Records Mercer County Property Valuation Administrator 207 West Lexington St Harrodsburg KY.

Apr 24 2017 1054 am. Find Property Records including. Bills must be paid by money order cashiers check or certified check.

As will be covered later appraising real estate billing and collecting payments conducting compliance tasks and resolving conflicts are all reserved for the county. Search for tax information. Public Property Records provide information on land homes and commercial properties in Lexington including titles property deeds mortgages property tax assessment records and other documents.

Find All The Record Information You Need Here. The average property on Windfield Pl was built in 1988 with an average home value of 114922. Search Mercer County property tax and assessment records by owner name address or map number including sales search.

The clerks responsibilities include. Kentucky property titles and deeds. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

The preparation and printing of property tax bills. Explanation of the Property Tax Process. The name and address on your property tax bill is provided to the Sheriff by the Property Valuation Administrator.

Property Tax Search - Tax Year 2021. For information on these bills please contact the Fayette County Clerks Office. 859 253-3344 Land Records Department.

All delinquent tax payments should be submitted by mail or drop box. Find Lexington Tax Records. Payment posting may take 2-4 weeks from January 15th for some mailings and on-site drop box.

Please select delinquent tax inquiryor call our office at 859 253-3344 for payoff information. Select an address below to search who owns that property on Briarwood Drive and uncover many additional details. They are a valuable tool for the real estate industry offering both.

Use our free Kentucky property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Fayette County Clerk 162 E.

From that date on a search on any bill which does not show a status of Paid indicates that the bill may be delinquent. The reader should not rely on the data provided herein for any reason. They are maintained by various government offices in Fayette County Kentucky State and at the Federal level.

Our property records tool can return a variety of information about your property that affect your property tax. New LexServ office serves citizens. Several government offices in KY state maintain Property Records which are a valuable tool for understanding the history of a property finding property owner information and evaluating a property as a buyer or seller.

Lexington establishes tax rates all within the states constitutional rules. Lexingtons Division of Revenue will be taking over the LEXserv billing system from Greater Cincinnati Water Works saving money for the city creating jobs and improving customer service efficiency. The average property tax on Briarwood Drive is 771yr and the average house or building was built in 1969.

132 Lexington KY 40507. Property Tax - Data Search. Lexington Permits 125 Lisle Industrial Avenue Lexington KY 40511 859-425-2255 Directions Fayette County Property Records Databases The Fayette County Property Records Kentucky links below open in a new window and will take you to third party websites that are useful for finding Fayette County public records.

The primary duties of the Assessors Office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records. A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky. Tax Records include property tax assessments property appraisals and income tax records.

It also adds and values new properties and conducts a reassessment of all properties every five years. Unsure Of The Value Of Your Property. Lexington County implemented a countywide reassessment in 2015.

We found 61 addresses and 61 properties on Briarwood Drive in Lexington KY. Lexington KY 40507 Tel. This website is a public resource of general information.

For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name. Certain Tax Records are considered public record which means they are available to the. Certificates of Delinquency will be recorded in the Fayette County Clerks Office on all unpaid property tax bills the day after the final payment deadline for the current tax year.

Search for free Lexington KY Property Records including Lexington property tax assessments deeds title records property ownership building permits zoning land records GIS maps and more. If this information is incorrect or otherwise needs to be changed please contact the Property Valuation Administrator at 859 246-2722.

Lexington Ky City Property Taxes Won T Go Up Lexington Herald Leader

1927 Spring Station Dr Lexington Ky 40505 Realtor Com

Mortgage Calculator Estimate Mortgage Payments

Lexington Ky A Great Place To Retire For Your Health Kiplinger

Lbar Com Listing 1118160 Lexington Lexington Ky House Styles

Developers Get Farmland Tax Break As Bulldozers Approach Lexington Herald Leader

351 Chamberlain Dr Lexington Ky 40517 Realtor Com

Lexington Fayette Kentucky Ky Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2333 Southview Dr Lexington Ky 40503 Realtor Com

1167 Oakwood Cir Lexington Ky 40511 Realtor Com

Moving To Lexington Here Are 19 Things To Know Extra Space Storage

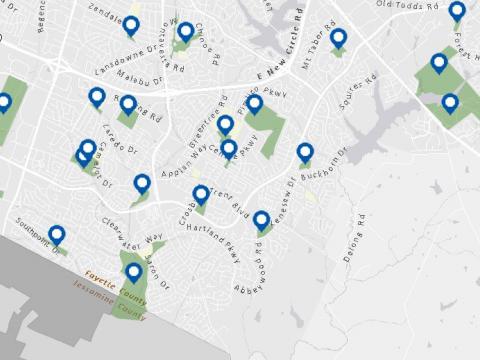

Geographic Information Services City Of Lexington

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

Map Of Lexington Kentucky Area What Is Lexington Known For Best Hotels Home

Kentucky League Of Cities Infocentral

Developers Get Farmland Tax Break As Bulldozers Approach Lexington Herald Leader